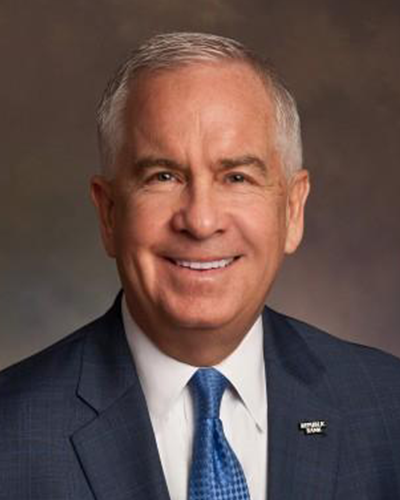

Christopher Brandriff

Christopher Brandriff is a Managing Director and Market Manager for J.P. Morgan Private Bank’s Greater Florida market. He is responsible in overseeing the Firm’s Private Banking business in our Tampa, Sarasota, Naples and Orlando offices. Chris leads a group of bankers and specialists to help affluent families bank, borrow, invest and plan. They work in concert to design integrated strategies that are tailored to the specialized needs of each individual.

Chris fosters an environment of excellence to advise families, business owners, entrepreneurs and professionals in a customized and high-touch manner. He uses a solution-based process to deliver the strengths of J.P. Morgan, including the intellectual capital and investment platforms available through the global capabilities of the firm.

A graduate of the Virginia Military Institute (VMI), Chris earned a B.S. in Civil and Environmental Engineering. While there, he was an NCAA Division I Track & Field athlete and an ESPN First Team Academic All-American. Chris’s involvement in an investment committee at VMI drove his interest in the markets and led him to further his education. He holds an M.B.A. from the Darden Graduate School of Business at the University of Virginia.

With more than ten years of experience, Chris began as an Investment Banker in the Power & Energy Group at Citigroup, advising clients on strategic alternatives and efficient capital allocation. Pivoting toward personalized wealth management, he joined the Private Bank at its headquarters in New York City as a Client Advisor for successful individuals. In 2017, Chris relocated to Tampa Bay to help build out the private wealth management business on the West Coast of Florida. He is a former member of the Advisory Council, a cross-disciplinary team that provides long-term strategies for major initiatives undertaken by the firm.

Chris, his wife Meagan, son Lawson and daughter Parker are grateful to now live in a climate that allows them to participate in outdoor activities year-round. In his free time, Chris enjoys sports, fishing, and cooking for his family.